Providing digital payment options like credit cards and automated clearing house (ACH) payments can increase sales and improve cash flow. However, working with multiple payment processing systems can create challenges for your sales, order management and accounting staff.

NetSuite SuitePayments accommodates all your payment acceptance needs—whether you’re taking payments online via a NetSuite web store, settling an outstanding invoice with a one-time payment or billing customers on a recurring basis.

As a seamlessly integrated component of NetSuite, SuitePayments gives you updated accounts, inventories and customer records in real time, with full payment card industry (PCI) compliance.

Let’s explore how SuitePayments can improve your current payment acceptance processes in NetSuite.

Payment Services

Within the platform, you’ll have integrated processing and secure management of credit card transactions and digital payments alongside NetSuite’s SuitePayments partners.

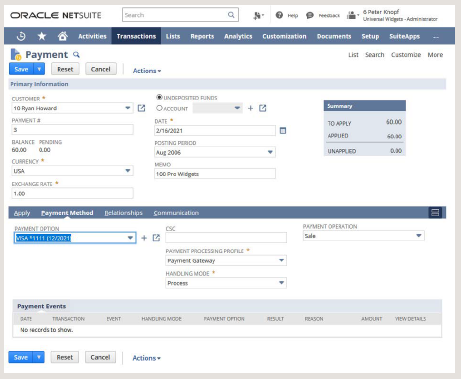

SuitePayments includes PCI-compliant, partner-certified communication with the payment gateway. Payment credentials can be stored in NetSuite as part of the customer record, and all payment events are logged in real time and associated with the transaction record (sales order, cash sale, deposit, payment or refund).

Billing Management

You can take invoice payments over the phone and process them within NetSuite. Customer-initiated payments are supported through a “pay now” link on the emailed invoice or allowing sign-in to the NetSuite Customer Center or MyAccount portals.

For recurring billing needs, SuitePayments helps minimize declined payments by including “Card-on-File” and “Recurring Indicator” flags credit card providers look for, and by supporting “Account Updater” services provided by the SuitePayments partner.

eCommerce

During checkout, NetSuite SuiteCommerce uses SuitePayments payment gateway integrations to obtain credit card authorization to settle against after fulfillment. Advanced fraud screening and 3D Secure authentication can be employed at checkout. PayPal Payments, Express Checkout and other external payment methods are also supported.

Point of Sale

You can benefit from ERP integration and reduced transaction rates by using a SuitePayments partner provided Europay, Mastercard and Visa (EMV) chip card reader at the point of sale, either with or without SuiteCommerce InStore. No-touch near field communication (NFC)-supporting options are also available.

Use a credit card to settle outstanding invoices

Challenges You Can Avoid

As an integrated payment acceptance platform, SuitePayments can help you dodge the following headaches:

- Duplicate Data Entry

Eliminate errors and the resulting delays from needing to log in to another system to manually charge your customer’s credit card and then update records in your accounting system. - Costly Integrations

Avoid the financial and IT resources required to build and maintain integrations with multiple payment gateways, while supporting your entire business with a single payment solution. - PCI Data Security Burden

Reduce the costs and complexity associated with PCI compliance by removing your company network and infrastructure from the processes used to transmit sensitive credit card data.

Need Help?

If you’re interested in learning more about SuitePayments and how you can enhance payment processes for your business in NetSuite, contact us online or give us a call at 410.685.5512.

![[TSG] 11-9-22 ERP webinar recording image](https://www.gma-cpa.com/hs-fs/hubfs/11-9-22%20ERP%20Webinar/%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png?width=500&height=500&name=%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png)