NetSuite’s Fixed Assets Management provides you with the power to eliminate spreadsheets and manual effort from your company’s asset and lease management processes.

Today, I’m breaking down how easy it is to navigate this module in five simple steps.

Let’s jump in!

Step 1: Setup Structure

First, setup your organization’s general asset structure and reporting preferences. NetSuite allows you to transfer assets between subsidiaries. You will need to define asset transfer inter-company GL accounts to support transfers of assets between subsidiaries. Also, you will need to define your asset types, which may be as simple as buildings, leasehold improvements, furniture and fixtures, computer equipment, machinery and vehicles. Every new asset is required to have an asset type to default specific variables, such as a default depreciation method, as well as a group for processing and reporting.

Next, you will need to assign a depreciation method to each new asset. An asset can have a specific depreciation for the first part of its lifetime and change methods later for the asset’s remaining life. The most popular depreciation methods are included out-of-the-box with NetSuite. You can also create custom depreciation methods by copying and modifying an existing formula.

Lastly, you can attach multiple alternate methods (tax depreciation methods) to an asset, which will not be used for accounting purposes, i.e. not linked to general ledger journal postings.

You can also track asset insurance, leasing, components, usage, income/expense and maintenance information.

Step 2: Asset Proposal and Creation

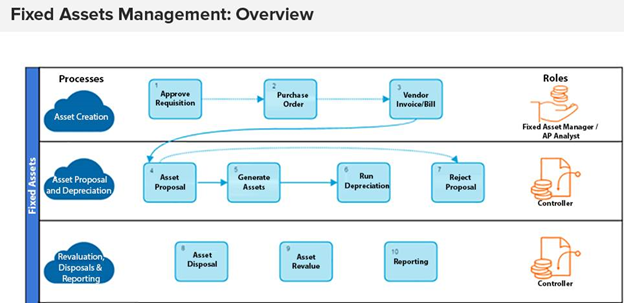

Assets are typically created from your requisition > purchase order > vendor bill transactions.

The asset proposal process allows you to select one or more asset types to propose. For example, if you propose computer equipment for a specific subsidiary or multiple subsidiaries, NetSuite’s fixed asset system will search and return a list of all new transactions. You can simply accept or reject a proposed asset or edit by drilling into a specific asset to change any default variables assigned from the asset type setup prior to accepting. After you have massaged your asset proposal list, simply select all and generate your new assets.

You can also go straight to mass asset creation which creates new assets for all transactions found in NetSuite skipping the proposal process.

Lastly, you can simply create a new asset which does not have an associated transaction in NetSuite and if you have a long list of assets you are converting from an external fixed asset system, NetSuite offers a data import.

Step 3: Depreciate Assets

Select one or more asset types and subsidiaries to depreciate for a period. A bonus feature is that you can select a date in the past. You have full visibility of journal history on the asset record, which links to general ledger allowing easy troubleshooting, as necessary.

Step 4: Asset Disposal and Revaluation

As needed, write-off or sell a simple or compound asset (asset disposal). You can add disposal types other than write-off and sale. For example: theft. When selling an asset, NetSuite allows you to select a customer, sales tax code, sale item number and sales amount. And get this — general ledger entries will be made for you!

As part of your year-end review, you may need to revalue an asset where its current value is no longer in line with its original value. You can enter either the write-down percent, the amount or adjust the residual value as well as adjust the asset’s lifetime and depreciation method. Revaluation only supports accounting methods associated to the accounting book and does not apply to alternate methods (tax depreciation methods).

Another plus is that you can split assets.

Step 5: Fixed Assets Analytics

Another great feature of NetSuite is that you can report on assets across locations, subsidiaries, asset types and more. Report values are organized by subsidiary and accounting book. Within a specific subsidiary and accounting book combination, the values are further organized by asset type.

Here are four examples of reports:

- Asset register: Listing cost, accumulated depreciation, and net book value

- Asset summary: Showing valuation, depreciation and net book value by asset type and specified period

- Depreciation schedule net book value: Showing current value for the specified period

- Depreciation schedule period: Lists total depreciation of each asset for the specified period

Finally, you can view reports and/or download to .csv, xml or pdf formats.

Here's an overview of the process:

Need Help?

Not all ERP systems include this suite feature, but NetSuite does! The plus side? There is no need to search for an extension vendor. You can learn more about NetSuite's Fixed Assets Management module here.

There is a reason NetSuite is one of the world’s leading Cloud ERP software solutions, as it is trusted by more than 22,000 customers across the globe.

Interested in seeing a system like this in action? Contact us online or call 410.685.5512.