Accurately assessing and reporting the results of your work is critical to determining your nonprofit’s impact. How else can you tell if funding is being used appropriately or if your organization is accomplishing its goals?

Clear methods of gathering and analyzing program outcomes are a must-have to legitimize your organization and its cause. You want to convey your efforts in a way that shows not only your organization's purpose, but its worth.

So how do you get there?

When Accounting Systems Fall Short

When a 7.0 earthquake flattened Haiti in 2010, millions of donors rushed to help, funneling money to a large global humanitarian organization. Contributions climbed to half a billion dollars in one of the most successful online fundraising campaigns ever. But five years later, only six homes had been rebuilt.

Nonprofits, including the American Red Cross, have learned plenty since 2010. Although the organization continued to defend its disaster relief efforts, it didn’t provide a public summary of how its donations had been spent. Nor would it ever.

Investigative reports showed that the nonprofit had outsourced Haitian projects to local affiliates and lacked the accounting mechanisms to connect the dollars it raised to any achieved outcomes. While it’s possible that the organization had indeed rebuilt entire Haitian villages, it couldn’t prove it, leaving its public reputation in shambles for a few years.

Stories likes this one make donors distrust nonprofits and make nonprofit executives squirm. Charity leaders know how hard it is to convey a mission’s impact to supporters. Doing this is made more difficult by confusing nonprofit accounting regulations and having a philanthropic culture that hamstrings organizations from fully delivering, much less evaluating their programs.

Peter Orza, the former director of the federal Office of Management and Budget, echoes this common funder sentiment perfectly: “Public funders — and eventually private funders as well — will migrate away from organizations with stirring stories alone toward well-managed organizations that can also demonstrate meaningful, lasting impact.”

How Nonprofits Measure Impact

How do nonprofits adequately measure impact when they’re attempting to help solve complicated issues — like global climate change — that are influenced by civic, individual and corporate behavior well beyond the control of just one organization? And who determines the criteria of a well-managed nonprofit?

In the last decade, watchdog agencies like Charity Navigator have introduced various metrics of nonprofit effectiveness, including the overhead ratio, which uses low overhead as a benchmark for mission effectiveness.

While overhead investment may go against traditional philanthropic opinions, a growing number of capacity building organizations, like the Nonprofit Finance Fund, are embracing full-cost funding and are partnering with grant makers to demonstrate that philanthropic support for overhead spending is urgently needed.

Evaluating Mission Effectiveness

To kick off their educational series “Mastering and Measuring Mission Impact,” NetSuite asked 353 nonprofit executives whether and how they evaluate mission effectiveness.

NetSuite asked nonprofit executives if they were familiar with logic models and whether they’re using outcomes measurements to determine the impact of their programs. NetSuite wanted to know if they were aware of Charity Navigator metrics and whether they used them, and wanted to determine whether they correlate programs to financial metrics to create dollars-to-outcome transparency.

To frame the survey participant’s responses, let’s explore the following topics.

Outcomes Measurement

Outcomes measurement is an approach to assess the social impact a nonprofit creates. Nonprofit researcher Robert M. Penna says that the charity sector for most of its history has not had to prove its impact on the issue area for which the organization was created. Most nonprofits have focused on what they are doing, not how they have impacted change.

In his book “Braided Threads,” Penna states that nonprofits are unable to measure impact for two primary reasons:

- Lack of definition. The target problems, actual programmatic interventions, expected outcomes and desired impacts have not been sufficiently defined to be measurable.

- Lack of clear program results tied to resource expenditure. Expenditure of resources such as time, people and money have not been linked to outcomes.

Logic Models to Build and Measure Change

Program delivery for nonprofit organizations is the heart of the sector. Food banks deliver canned goods to food-insecure communities; domestic violence shelters provide beds to battered women; environmental organizations advocate for green energy. Without programs, the nonprofit sector has no meaning.

Formal evaluation of program delivery has been integral to demonstrating outcomes since the mid-70s when the Kellogg Foundation began to develop methodologies with the United Way to fund, monitor and evaluate its programs.

Logic models and theories of change describe two common methodologies used to create programs and measure their impact. Program evaluation staff uses logic models, but financial evaluation sits with the finance office. Meanwhile, watchdog agencies have created an entirely different set of criteria for success.

The Accounting Rules That Govern and Constrain Nonprofits

Nonprofits are bound by Financial Accounting Standards Board (FASB) regulations to categorize each donation based on donor intent (restriction) and allocate each expense as either an administrative, fundraising or program cost (functional expense). These two simple accounting rules have a fundamental, far-reaching and cascading impact on the nonprofit sector.

The inability of the humanitarian organization to articulate its Haitian disaster relief effort boils down to an inadequate accounting of source and use of funds — in other words, restriction and expense allocation.

Compliance as Controversy: Restrictions and Functional Expense Allocations

Your fundraising operation and accounting staff must ensure that they mark each contribution as either for general operating costs (without donor restrictions) or with donor restrictions. For example, if a fundraiser creates a giving campaign for Haitian relief, each dollar contributed must be tagged as such and can’t be comingled with general operating funds.

Conversely, every expense must be allocated into fundraising, programmatic and operating buckets. Because many expenses span all three categories (indirect costs), finance staff creates allocation schedules that divide office supplies, human resources and other expenses across functional expense categories — a laborious, time-consuming and inexact process.

Data from these expense allocations are reported on nonprofit 990s and used by charity watchdog agencies to calculate program, administrative and fundraising efficiency. Increasingly, finance leaders are critical of the time spent on functional expense allocation and the harsh judgement heaped on nonprofits when money is spent on general operations or infrastructure.

What’s missing in headlines about nonprofit spending is the complex accounting regulations that restrict nonprofits from spending money where it’s most needed. This includes the fact that functional expense allocations, even when applied shrewdly, are subjective and the negative public opinion of overhead that makes nonprofits hesitate to report on full costs, creates a cycle of underfunded and destabilized programs.

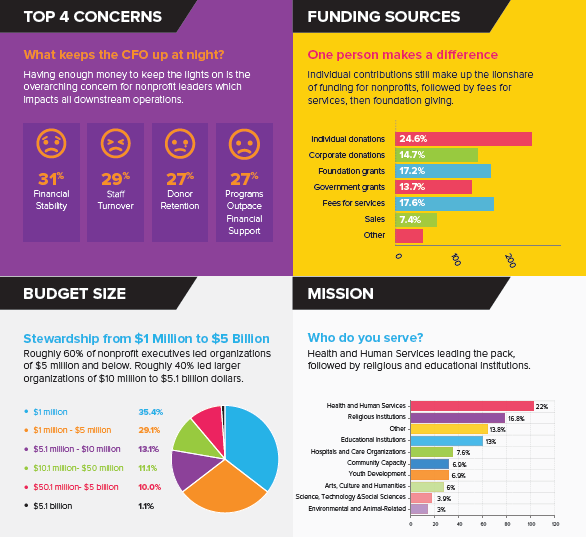

Survey Demographics

What does it mean to measure change? NetSuite also asked the 353 nonprofit executives if and how they evaluate mission impact.

Are they using outcomes measurements to determine program effectiveness? Do they use Charity Navigator metrics? What works and doesn't when evaluating impact? Explore the findings below.

Need Help?

Our team has a deep bench of CPAs and consultants with expertise in both the nonprofit sector and NetSuite software. If you’d like to learn whether NetSuite could be a fit for your nonprofit, contact us online or give us a call at 410.685.5512 to schedule a demo.