A powerful enterprise resource planning (ERP) system is central to optimizing operations across roles and departments. However, ERPs don’t automate accounts payable (AP) processes.

AP is consistently ranked by financial executives as the single most time-consuming function in finance — but don’t worry! You can advance your AP processes with payables automation to get the most out of your ERP investment.

We’ll focus on NetSuite in this article, but payables automation solutions can integrate with several other ERP systems including Microsoft Dynamics 365 Business Central, Microsoft Dynamics GP and Sage 300.

Payables Operations In NetSuite

NetSuite functions as an important system of record that collects, stores, manages and monitors essential business data.

But for AP, NetSuite does not automatically record a vendor bill, approve it and pay the vendor. ERPs align with third-party solutions for automating procure to pay, thus reducing accounts payable staff and reducing time-consuming and labor-intensive tasks along with costly human errors.

The Costs and Demands of Payables

When it comes to data entry and invoice processing, many organizations face complexity and inefficiency with the following demands of payables:

Complexity

- Maintaining multiple banking/payment rails

- Dealing with unique payables requirements

- Diverse supplier population

- Global/cross-border factors—payment rails, regulatory compliance, etc.

- Fraud controls and purchase order (PO) matching protocols

- Multiple-entity/multiple-subsidiary structures

Inefficiency

- Collection and data entry of invoice details

- Manual interface with bank systems/payment processors

- Onboarding and communicating with suppliers

- Disconnected point tools (invoice/PO-matching, workflow, tax, payments, etc.)

- Manual chasing down of PO, invoice and payment approvals

- Reconciliation of payment data

To reduce the cost of payables operations, some organizations hire inexperienced staff to perform tasks such as collecting supplier payment information, keying in and matching invoices, collecting tax documents and mailing checks or paying through a bank portal.

This can create an audit-inducing dilemma. Below are issues your finance team needs to be ready for:

- Meeting Foreign Account Tax Compliance Act (FATCA) tax regulations in the face of increasing IRS audit activity (i.e., 3,000 new examiners, up to 30% fines for the payer)

- Gaps in financial controls and PO/invoice/payment approvals within and across subsidiaries

- Poor data hygiene leading to late or duplicate payments

- Exposure of bank accounts to check and wire fraud

Any time someone has access to sensitive supplier information and company funds, your organization is exposed.

Transforming Your AP Processes

The payables process is essentially a dozen different interdependent processes. Rather than continuing to piece together one tool—only to have to deal with replacing it later— finance operations need to strive for self-contained solutions that work together.

Payables departments need to have an integrated philosophy that encompasses the following:

- Intelligent supplier onboarding

- Identity and tax data collection and validation

- Supplier payment/bank account detail collection and validation

- Invoice and purchase order workflow and processing

- Payment remittance (domestic and international)

- Payment reconciliation across payment methods and entities

- Supplier communications

A successful transformation involves adopting a strategic payables directive and modernizing payables technology.

Adopt a Strategic Payables Directive

A primary goal of a strategic payables directive should be to include the payables function in your organization’s overall growth strategy, rather than as an afterthought.

This involves establishing longer payment terms without sacrificing the relationship with suppliers, ensuring corporate compliance and taking a lean approach to operations that’s designed to support ongoing expansion. This requires a culture shift in finance, recognizing that AP is a key enabler of strategic and successful operations.

Modernize Payables Technology

Modernizing payables technology gives you automated tools so that your organization is less focused on “payment runs” and more focused on strategic finance at large.

Payables Automation With Tipalti

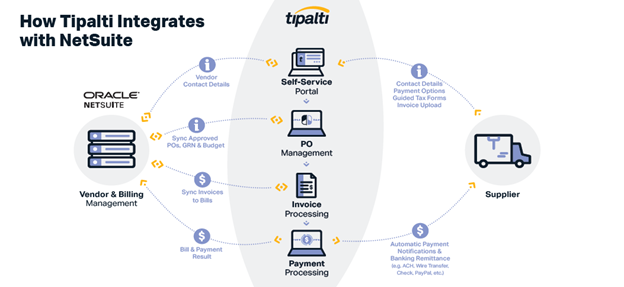

There are solutions, such as Tipalti, built to integrate with NetSuite to automate AP processes that would otherwise be left up to staff. Tipalti extends existing NetSuite capabilities by providing full management and automated execution of AP processes, including:

- Supplier onboarding

- Purchase order management

- Invoice management

- Payment scheduling

- Global remittance

- Communicating with suppliers

- Multi-entity reconciliation of payment details with invoices and billing

Tipalti integration with NetSuite

With AP automation, you can enhance NetSuite’s functionality to:

- Enable supplier self-service

- Provide payment status to suppliers 24/7

- Reconcile payments in real-time

- Gain control and visibility over your spend

- Streamline invoice processing and global bill payments

Note: As a payables automation platform, Tipalti integrates with any ERP system. Integrations include Microsoft Dynamics 365 Business Central, Microsoft Dynamics NAV, Microsoft Dynamics GP, QuickBooks Desktop, Xero, Sage 50, Sage 100, Sage 300, SAP Business and more.

Don’t Wait — Even If You’re Still Looking to Add NetSuite

If your organization has not adopted an ERP system and is looking to add NetSuite, you may think holding off on payables transformation would make sense until the core ERP is in place—which isn’t exactly true.

Waiting to deploy solutions until after NetSuite is implemented could cost your organization more in the long run because ERP implementations take time. This can also delay the benefits achieved through other modernization solutions—such as payables automation—that are outside the NetSuite implementation.

In fact, implementing the right payables automation solution will clean your vendor master record and AP reporting data, which can help ensure a smoother, more successful ERP implementation.

The key is to perform a value-based return on investment (ROI) analysis for your payables transformation project. Be sure to use real-spend data to make a proper assessment.

Need Help?

If you’re interested in taking your organization to the next level with AP automation, contact us online or give us a call at 410.685.5512.

![[TSG] 11-9-22 ERP webinar recording image](https://www.gma-cpa.com/hs-fs/hubfs/11-9-22%20ERP%20Webinar/%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png?width=500&height=500&name=%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png)