Account reconciliation is a critical first step in the financial close process. It establishes the foundation for month-, quarter- and year-end success. Accountants perform reconciliations at the end of accounting periods to ensure the general ledger (GL) balance is complete, up-to-date and accurate.

The reconciliation process involves comparing a company’s GL balance to independent data sources, like bank statements and accounting records, to ensure they match up. Accounting teams then investigate any discrepancies. This process helps reassure accountants and executives that the company’s books and financial statements are current and accurate.

Account reconciliation involves two processes: matching and reconciling accounts. Matching involves comparing the transactions recorded in an organization’s accounting system with those recorded by external parties, such as banks or vendors, to ensure they align.

This may involve verifying that the amounts, dates and other details of transactions are identical across both sets of records. Reconciling involves identifying and resolving discrepancies between the accounting records of the organization and those of external parties. It may require investigating differences in recorded amounts and identifying missing transactions, such as missing deposits or unauthorized withdrawals, so they can be corrected. This can help prevent financial losses due to fraud and improve the overall financial health of the organization.

Common Account Reconciliation Challenges

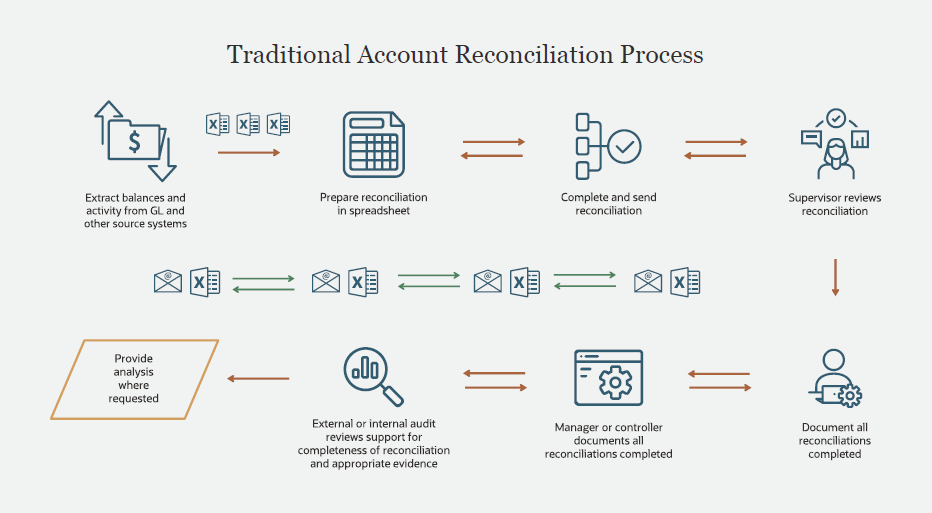

Despite technological advances, accounting professionals still rely heavily on spreadsheets to manage extensive, highly detailed reconciliations. And because of that, organizations still spend too much time and money on the process.

When accounting teams find themselves buried in a mountain of data that needs to be entered and reviewed manually to match and validate transactions, the potential for mistakes is high. And the more steps involved, the more potential for costly errors that can not only delay the financial close but increase compliance risk and add to that mountain of work.

Other problems associated with manually reconciling accounts include:

- Data accuracy: A primary challenge in account reconciliations is ensuring the accuracy of the data being reconciled. This can be especially trying when manually matching transactions and dealing with large volumes of data, multiple systems or complex transactions.

- Timeliness: Another challenge is reconciling accounts in a timely manner, given how long manual processes take. Late reconciliations can result in missed opportunities to detect and correct errors or identify fraud before the period close, which can have serious financial consequences for the organization and invite scrutiny from regulators.

Traditional Account Reconciliation Process

- Poor visibility: Discrepancies among data sources used in the reconciliation process make it difficult to identify and resolve errors. Additionally, if the reconciliation process is not properly documented, tracked and audited, it can be challenging to detect and address errors or fraudulent activities.

- High-volume and complex transactions: Dumping thousands of transactions into spreadsheets and combing through hundreds of rows of numbers to match data from multiple sources means that some reconciliations may fall through the cracks—even as your accountants spend weeks uploading, locating and manually matching transactions.

- Compliance risk: Using spreadsheets and emails in the reconciliation process weakens financial controls and makes it harder to comply with rules and regulations because of a lack of workflow control between preparer, reviewer and final approver. Accounting teams that reconcile their finances manually elevate the chance of fraud, pose risks to the integrity of financial statements and ultimately face more compliance issues.

- Collaboration: Reconciling accounts often involves multiple stakeholders, including controllers, accountants, auditors and other finance professionals. But collaboration can be difficult when using spreadsheets, which come with access and version control issues, communication delays, an increased risk of errors and security concerns. Getting everyone on the same page is a chore.

Automate the Account Reconciliation Process

As a repetitive and time-sensitive process, account reconciliation is ripe for automation. Technology can match records from multiple systems or accounts much faster than even the best human accountant. Once automated, accounting staff can focus on investigating items from an exceptions report rather than checking each entry. Businesses save time and reduce errors.

Automation is becoming an increasingly popular solution to the reconciliation challenges outlined earlier. Accounting software can reduce the time and effort required to reconcile financial records. It can identify discrepancies quickly and accurately, letting teams resolve them quickly. In the past few years, forward-thinking companies have turned to automation to handle rote tasks within the reconciliation process, such as data entry, sorting data, reviewing transactions, comparing data sets, investigating discrepancies and creating compliance dashboards and reports.

By leveraging proven technologies, leading organizations are moving away from tedious, time-consuming reconciliation tasks and refocusing on efforts that grow the business.

Close Faster By Automating Account Reconciliation With NetSuite

An automated account reconciliation solution is not just a win for the accounting team. It quickly delivers long-term benefits to the entire business. With less time spent copying and converting data, manually matching transactions and double-checking for accuracy, accounting staff can reallocate time to strategic financial reporting and analysis. An automated solution helps businesses identify and resolve discrepancies more quickly, reducing the risk of errors and fraud. This can lead to improved financial transparency, better decision-making and increased stakeholder confidence.

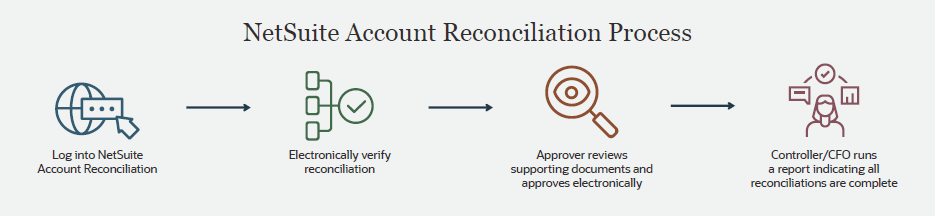

NetSuite Account Reconciliation automates GL account reconciliations, matching bank reconciliations, credit card transactions, intercompany transactions, accounts receivable and payable—all in one centralized workspace. This allows you to eliminate manual ticking and tying and detects errors and discrepancies so your accounting team can focus on exceptions, high-risk reconciliations and other strategic work that deserves their attention.

The NetSuite Account Reconciliation package includes two components used in tandem.

Reconciliation Compliance

Use provided formats and templates to support the most common reconciliation accounts or create custom formats to meet your requirements. NetSuite’s Account Reconciliation solution provides audit trails and securely stores supporting documentation to ensure reconciliations remain unaltered. That makes for easy verification by auditors.

Approval workflows send notifications to approvers via email and capture confirmation of signoffs. The module also gives you flux analysis to monitor balance fluctuations and explain why thresholds you set are exceeded.

Transaction Matching

NetSuite Account Reconciliation lets accountants create flexible matching rules for individual transactions or groups of transactions, such as one-to-one, many-to-one and many-to-many matches, to speed up the reconciliation process. The auto-match engine matches millions of transactions in minutes. Operational and compliance dashboards show which reconciliations are complete, open or late and list the responsible party as well as variance details and commentary.

Automating the account reconciliation process with NetSuite Account Reconciliation offers meaningful benefits so accounting teams can accelerate the financial close, produce timelier and more accurate financial statements, and reduce risk.

NetSuite Account Reconciliation Process

Need Help?

Our Technology Solutions Group includes a team of experienced solution experts who will work with you to understand and address the specific needs of your business. If you’d like to improve your organization's account reconciliation processes, contact us online or give us a call at 410.685.5512.