Can a hawkish Federal Reserve pull off a soft landing for the economy while putting a lid on inflation? We’ll have to wait and see. But CFOs in leading firms aren’t banking on anything. They’re taking steps to keep their companies on an even keel no matter where the economy goes.

Not that a soft landing is impossible; there are causes for optimism with a better-than-expected gross domestic product report (GDP), which showed GDP up by an annualized rate of 2.9%, combined with slowing inflation and avoidance of a rail strike that could have snarled supply chains further.

NetSuite compiled these seven steps to help set your company up to weather whatever happens next. Even if a downturn never materializes, these measures will make your business more resilient and ready for nearly any circumstance.

1. Constantly Assess Cash Flow and Employ Rolling Forecasts

Preparing for a downturn, sudden upswing or market opportunity starts with a cash flow analysis to assess your working capital and continues with establishing rolling forecasts that will help you dynamically adapt to market and economic changes.

Resilient CFOs keep a particularly close eye on their companies’ free cash flow, or the money left from revenue after subtracting operating expenses and capital expenditures. That gives leaders a clearer view of the cash available for financial reserves, expansion investments or discretionary spending.

Once you have a handle on cash, implement a rolling forecast methodology that allows you to continuously update your assumptions.

The defined period you use for your forecast should vary based on conditions. Common options include forecasting for the next 12, 18 or 24 months. When a recession is possible, shorter is better to reliably project outcomes — your focus is on getting accurate cash flow projections for the next quarter or two.

Well-prepared CFOs also:

- Keep an eagle eye on their cash on hand. The longest recession since World War II was 18 months, so when a downturn is on the horizon, the goal is to have enough capital reserves to make up the difference between various levels of reduced earnings and the income needed to maintain operations for that length of time.

- Know their liquidity options. Businesses that line up capital sources before they need to access funding are better positioned to get favorable terms. Funding sources may include revolving loans and other credit lines, owner infusions, alternative financing, private equity and government resources, such as Small Business Administration (SBA) loans.

- Bake customer and supplier health into the cash calculation. Top CFOs use technology, including a data warehouse, to keep their fingers on the pulse of key customers and suppliers. Begin quarterly business analyses of all, or at least your largest, customers. Identify where you may need to enforce contracts to control your exposure and which clients might be slow or unable to pay. Consider adjusting terms or throttling lines of credit where appropriate. Some companies use downturns as an impetus to “fire” unprofitable customers.

Negotiating payment plans with suppliers while offering incentives to customers for early payments or bulk orders not only improves cash flow but may create goodwill that lingers.

2. Maintain Tiered Forecasts With Proactive, Yet Surgical, Cuts

CFOs who don’t stress excessively about downturns have a variety of spending plans in their back pockets that align with likely economic conditions and their own cash flow realities.

One approach is as simple as compiling tiered forecasts representing cuts to respond to revenue reductions of 10%, 20% and 30%. All line items are on the table, and plans include enough specificity that the CFO is confident the company can achieve expected savings if needed.

Aim for cuts that you can dial back as conditions improve. Layoffs, for instance, are not easily reversed, particularly given persistently low unemployment. For some historical perspective, leaders who weathered the 2008 recession may recall a report called “Roaring Out of Recession” that Harvard Business Review (HBR) released in 2010. It looked at data from 4,700 public companies during the three years before the recession, the three years after and the recession years themselves.

HBR researchers found that 17% of those companies went bankrupt, were acquired or became private. The majority had not yet regained their pre-recession growth rates three years after the official end of the downturn. Only about 9% prospered after the slowdown, defined as outperforming both their own previous performance and their rivals by at least 10% in terms of sales and profit growth.

What did those leaders do right? Turns out, massive cost reductions don’t predict success. In fact, companies that made deep cuts had the lowest probability (21%) of pulling ahead of the competition when times improved. Increases aren’t the answer either. Businesses that invested more than their rivals during the recession had only a slightly better (26%) chance of becoming leaders after a downturn.

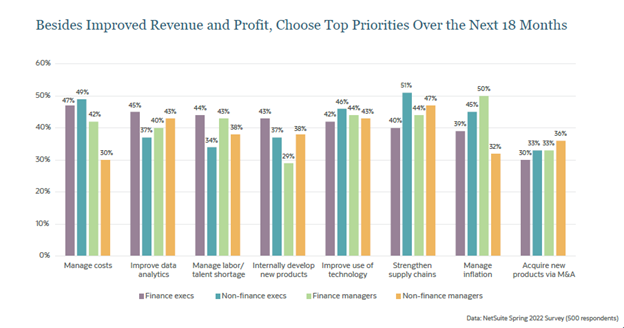

Top priorities over the next 18 months

Then, they rate activities to ensure spending nurtures these capabilities. This rating process is typically based on three questions:

- What do I need to keep the lights on? For example, sales and general and administrative expenses.

- Where am I spending that will make a difference over time in terms of winning in our market?

- How do I keep the rest as lean as possible?

Once you’ve identified what matters, consider using a modified version of zero-based budgeting, where expenses are justified one by one and budget owners must show how spending aligns with identified key capabilities.

Zero-based budgeting had a mini popularity boom during the pandemic, as CFOs looked for strategic, targeted savings opportunities. It can be time-consuming and labor-intensive, but finance leaders find it’s often worth the effort when their companies have many fixed costs, duplicative spending across the organization or budget silos that limit visibility.

Travel and entertainment (T&E) spending is generally the first area to see deep cuts. Outsourcing certain high-cost functions may also be an option, as is slowing or stopping speculative projects until the economy picks back up.

One quick way to get staff to rethink their habits is requiring executive approval for most discretionary spending. There’s nothing like justifying expenses to the CEO to make requesters assess the criticality of any outlay. New controls, policies, approval workflows and more visibility through better software all help keep a lid on spending.

Employee layoffs, real estate consolidation and other asset sales, along with eliminating product or service offerings, are more drastic efforts that CFOs know will be difficult to roll back.

Here are examples of tiered scenarios with associated responses:

Scenario 1: A Short Recession and Quick Bounce-Back

In this scenario, the recession lasts about six months. If your company has less than six months of cash and debt capacity, operating expenses should be reduced on the order of 5%, with a particular focus on reining in variable, nonessential costs such as travel.

Extend payment terms with vendors to the extent possible. Delay hires that aren’t critical to the functioning of the business. Headcount reductions are likely unnecessary now, though salary reductions may be instituted for a temporary, pre-set period to extend your runway. Make the cuts needed to extend your cash runway beyond six months, minimum.

Scenario 2: A Six to Eight-Month Recession and Gradual Recovery

In this scenario, resembling a swoosh-shaped recovery, the recession lasts six months or slightly more but the economy takes longer to bounce back. If your total projected revenue, cash and debt capacity do not exceed nine months, then beyond the moves recommended in Scenario 1, map out headcount reductions and steeper cuts in operating expenses in the 10% to 15% range. Pencil in the moves needed to take your cash burn to nine months.

Scenario 3: Lowered Revenue Extends Past Eight Months, and Recovery Is Sluggish

In this scenario, business drops then flatlines for six months or more. Operating expenses must be reduced beyond the relatively modest cuts in the two scenarios above, on the magnitude of 20% to 25%. Plan further headcount and other reductions to preserve a cash runway of at least nine months, ideally 12.

3. Embrace Customer Segment Analysis Exercises

While no company is completely immune to a downturn, many industries and business models are recession-resistant, meaning they fare well even when other companies are slashing costs and struggling to survive. The most recession-wise CFOs know this and take lessons from these firms.

Consider how customer demand and supply availability might change if the economy slows. Are you certain of your products’ extravagances versus necessities? Modeling likely buyer behavior will provide insights into how you might adjust production.

On an individual level, customer analysis is critical. Look at how client businesses weathered the pandemic, how many are at risk, and at what level and percentage of your revenue comes from those who might not survive an extended downturn.

Your ERP system can generate data to gauge the financial health of customers. Consider running per-client business reviews of metrics, including current accounts receivable, return on sales (ROS)/operating margin and sales growth rates to spot changes in buying patterns that could indicate a decrease — or an increase — in demand for the customer’s products or services.

Also, mine this data to see which clients might benefit from proactive outreach, whether to head off slow payments or upsell those that could benefit from more of your product or service.

Can you adjust the rates on some service offerings to keep cost-conscious buyers from canceling?

Examples of enticements include product bundling and unbundling, installment plans and the ability to add or remove features. In recessionary times, value sells. How might you give the customer more while still meeting margin goals?

4. Evaluate the Supply Chain On a Set, Regular Basis

When recessions hit, customers may stop buying, while suppliers cancel orders and delay deliveries. Recession-wise CFOs know that the last thing they want is to be left with idle production lines and some orders they can’t fulfill even as other inventory piles up.

That’s why these CFOs closely monitor upstream and downstream supply chain risks. Here’s how:

Run a Supply Chain Mapping Exercise

Build a map or flowchart of all suppliers, no matter how small. Keep the map updated as you add new partners and stop working with others. Use it to flag duplicate and single-source suppliers. Then, go a step further and evaluate suppliers to your most important suppliers. For example, if you purchase components that include semiconductors, where is the supplier getting its chips?

In some ERP systems, all information related to each supplier is located within a central vendor management record, so decision-makers can easily keep track of relationships and inform supply chain mapping efforts. Look for a vendor scorecard function to track supplier performance — and keep in mind that it won’t deliver insights without at least a couple of years of data.

Apply a Weighted Ranking

Devise a list of risk factors, like disruptions, financial dependence, credit history or susceptibility to recessionary pressure. Give each of those factors a weighted importance and each supplier a score of 1-5 for each, with 5 representing the highest risk. Then calculate the weighted average of those numbers to come up with a score that represents a supplier’s total risk. Consider the criticality of high-risk suppliers to your business.

Identify Areas for Diversification

Once you understand the risk attached to each supply chain partner, rate the areas where you need to add diversity by, for example, finding redundant sources for key parts and materials. One silver lining of a recession is you may find suppliers that were once overbooked will welcome your business.

Take Deeper Advantage of Your Vendor Management Software

If your ERP system offers a central record of all information related to each vendor, mine it to see if favored suppliers could provide components or materials that you currently purchase from a one-off supplier, thereby providing an opportunity to drive down costs and complexity.

Meanwhile, recession-wise finance leaders know that while many companies strengthened their supply chains over the past few years, a recession introduces new variables, like customers potentially opting for the lowest cost over delivery speed or higher quality. In response, CFOs may want to advocate for a shift in focus, favoring value pricing or supplier financial health over the ability to deliver materials quickly.

5. Get Involved In Inventory Management Strategies

CFOs understand that, from a financial standpoint, inventory impacts cash flow. Information about the location of products, their turnover rates, and exact status — on order, in transit, allocated to an existing customer — is tied to reorder dates and thus, to predicting future cash needs. When will the procurement team need money, and how much?

If your plan includes decreasing the use of incentives and specials, it’s time to focus on core offerings while watching inventory turnover.

Demand planning starts by identifying less popular, less profitable items. If necessary, here’s where you begin reducing production and inventory, turning to sales or volume discounters to get that stock out of your warehouse and off your books. Have systems and processes in place to zero in on the minimum inventory you need to reliably accommodate predicted swings in customer demand or supplier delays/outages.

The supply chain disruptions and rising prices and demand we’ve seen over the past year likely made your ops team hyper-focused on having enough stock to meet demand, with less emphasis on tight cash management. How might that calculation change in a recession? For one, financial management needs to be more prominent in your inventory management and material requirements planning strategies.

Three areas to assess:

- Ordering too much stock when demand is cooling increases carrying costs and ties up in inventory cash that you may need elsewhere. Stay on top of demand planning.

- Adjust your economic order quantity (EOQ) formula to recalculate all fixed orders that are triggered when stock reaches a predetermined minimum.

- Other inventory planning metrics you can track using your ERP include carrying costs, daily sales or movement of inventory, and forecast and system accuracy to quantify how precisely your system reflects physical stock.

6. Use Automation to Refocus Workers On Higher-Value Tasks

The job market is incredibly tight, and salaries continue to rise. Even if a recession eases the talent squeeze and brings labor costs down, or at least levels them off, payroll remains the biggest expense on a typical company’s balance sheet.

Therefore, it’s less expensive to upskill existing staff than to find and onboard new workers, even at a lower pay rate — especially if you need to train them.

Recession-aware CFOs don’t delay investing in technology that can automate manual tasks and, in the process, free up headcount for that upskilling and more strategic work. Whether in the warehouse, finance department or customer self-service, automation can negate the need to fill select empty positions while providing a path for existing workers to gain new skills.

Automation also gives businesses breathing room to reevaluate workflows, fine-tune processes and implement new technology. Advanced systems provide real-time data and reporting dashboards, including KPIs, enabling leaders to closely monitor results and react quickly.

In fact, automation closes the loop on monitoring cash flow, and it helps eliminate manual AR and AP tasks, speeding up the process while also reducing the number of errors. Automating manual accounting tasks delivers increased efficiency and better data quality, lowers labor costs and mitigates risks, including invoice fraud.

Where to start? Find three or five error-prone, human-based processes that suck the life out of staffers and leave decision-makers with incomplete or suspect data. Zero in on these repetitive manual tasks and figure out how you can automate them. Doing this now will set the business up for success as the economy resets itself for growth.

Three ways to score automation wins

7. Harness Technology for Scenario, Cash Flow and Other Planning

When growth slows, leaders scramble to get a holistic view of the business to make sure it’s operating as efficiently as possible.

Recession-aware CFOs don’t need to scramble because they regularly use insights gained in the previous steps to game out potential scenarios by modeling elements such as new sales, upselling and cross-selling to existing customers and business renewals on a monthly or quarterly basis.

As an example, compare freezing hiring for six months or a year versus building a workforce that can aggressively expand sales and take market share from your competition. What gets you the biggest win?

Top scenario planners use a three-step process to find out, aided by technology like ERP and financial software:

- Identify critical triggers even during uncertainty. When faced with a crisis, finance leaders quickly establish salient facts, like cash position, and develop guidelines for how the organization should respond. Scenarios are built on a set of assumptions around events that affect the survival of the organization and should trigger a series of actions.

- Develop multiple scenarios but keep it simple. It’s easy for finance teams to feel overwhelmed by the range of potential outcomes. That’s why it’s best to focus on two to three major uncertainties, like headcount needs versus salary and benefits costs, or accounts receivable risk, and build scenarios from there.

- Build a nimble response strategy. Each scenario should contain enough detail to assess the likelihood of success or failure of different strategic options. Once this is all established, finance leaders can create a framework that helps the executive team make decisions, then track results in real time so the company can be nimble in its ongoing response.

Key Takeaways

There’s a saying that recession-wise CFOs live by: “Fix the roof when the sun is shining.”

Slowing growth creates an incentive to reevaluate business processes, but ideally, planning and improvements begin when times are good. When growth slows, your people must work harder to make each sale. Restructuring when everyone is paddling as hard as they can is painful, so start working now to ensure your business is ready to ride out any potential storm.

Need Help?

If you’d like to learn how NetSuite can help your organization prepare for whatever the future holds, contact us online or give us a call at 410.685.5512.