The construction industry is diverse, with construction businesses specializing in HVAC, plumbing, electrical, excavation, fire protection, general contracting and other trades. One thing most contractors have in common, though, is who uses their financial statements to make decisions affecting the business’s future ― sureties.

Sureties underwrite the bonding for construction projects. Without bonding, contractors are unable to move forward with projects. That’s why construction owners need to know what sureties actually look for when they review a contractor’s financial statement.

We asked Tim Lambdin of Alliant Insurance Services and Bill Francik of HMS Insurance Associates to share what they look at when reviewing a contractor’s financial statement. Here’s what they said.

Advice from Sureties

Working Capital

Tim: Cash flow is the lifeblood of a construction company. A strong liquidity position gives bonding companies confidence that a contractor can manage the ups and downs of the construction process. A contractor who maintains a healthy bank line along with a strong working capital position relative to their backlog are viewed most favorably by bonding underwriters.

Bill: Working capital is a powerful metric that allows the surety to understand the contractor’s ability to meet current financial obligations and cashflow future projects. A very important component of working capital is “cash on hand.” The saying “cash is king” is absolutely true in the surety industry.

Working capital is the company’s allowable current assets less the current liabilities. I say “allowable” because some current assets are often discounted by the surety. For example, a loan receivable by a shareholder or a portion of accounts receivable that is in dispute is often discounted because they cannot always be relied upon to be collected.

Profitability of Ongoing Projects

Tim: Analyzing a contractor’s open projects provides visibility on how well they will perform going forward. Bonding companies can assess how much profit is remaining in the backlog to cover future overhead, how much financial and personnel resources will be needed to carry out the open work, and how new projects will fit into the overall bond program.

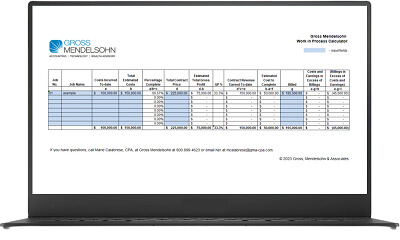

Work In Progress (WIP) Schedule

Bill: Sureties review WIP schedules to gain a better picture of the company’s backlog, profitability trends, billing practices and more. The WIP can provide a sense of what’s to come.

Sureties look at current backlog to gain an understanding of how much work is left to complete and how much profit is in these projects. This is compared to the current balance sheet composition to determine whether it is adequate to handle the current work on hand.

We will also look for profit fade (decreased profitability as jobs progress) and under/overbillings as key indicators within the WIP. The under/overbillings is an extremely important component of the WIP schedule, as it allows the surety to understand the company’s billing practices. Overbillings on a job occur when billings outpace the costs and earnings on a project. This can be a favorable indicator that you are managing cash well and working on the customer’s capital instead of your own ― so long as it’s not “job borrow,” which is using cash from one job to fund losses on another. Meanwhile, underbillings are when billings are not keeping pace with the costs incurred. This can often be a warning sign that the contractor’s billing practices are lacking or that the job will be less profitable than projected due to items such as poor estimating or disputed change orders.

Completed Job Schedule

Tim: This is one of the best ways for a contractor to demonstrate their resume. Bonding companies want to see what size projects have been completed, if they were profitable, and how well the original estimate aligns with the final profit. The completed job schedule speaks to the contractor’s estimating, accounting and execution capabilities and is a big predictor of how they will perform on future projects.

Net Worth of the Business

Bill: Net worth is basically the net equity (total assets less total liabilities) and is typically a representation of the accumulated profitability of the company over its existence. A strong net worth is indicative of the company’s historical profitability, dedication to leaving profits in the business and the ability to help weather downturns in the future.

And What Does the CPA Say About Financial Statements?

There’s an obvious theme in Tim's and Bill’s responses above ― a surety looks at simple yet reliable metrics when they evaluate a contractor’s financial statements.

Simple, as in the age-old adage “cash is king.” If the contractor’s cash position or cash flow is weak, it will stand out to a surety.

A contractor’s financial statement is reliable if, over time, it shows a history of strong results in terms of completed contracts and accurate estimation of job costs. CPAs can play an important role in helping contractors understand the needs of sureties. This advice, in turn, provides the sureties with a higher quality product ― the contractor’s financial statements ― with which to make their bonding decisions.

Need Help?

Contact us here or call 800.899.4623.

Bill Francik is a vice president with HMS Insurance Associates, a Marsh & McLennan Agency. Bill provides commercial insurance and surety services for his clients throughout the DMV region.

Bill Francik is a vice president with HMS Insurance Associates, a Marsh & McLennan Agency. Bill provides commercial insurance and surety services for his clients throughout the DMV region.

Tim Lambdin is an account executive lead for Alliant in the Washington, DC-Baltimore metro region. He handles bonding, insurance and risk management for his clients.

Tim Lambdin is an account executive lead for Alliant in the Washington, DC-Baltimore metro region. He handles bonding, insurance and risk management for his clients.