One of the most common questions we get from construction business owners is, “Should I own or lease my building”? The answer, which we will get to in a moment, might be simpler than you think.

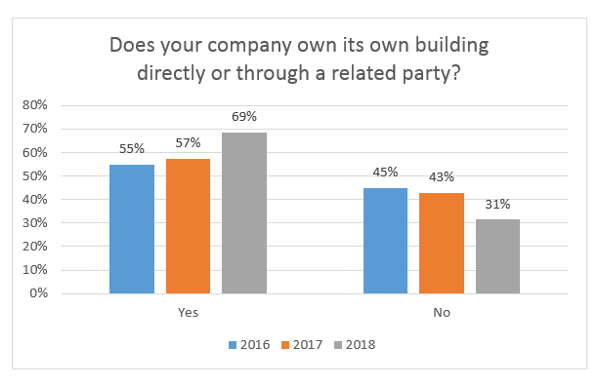

When we polled construction contractors for a recent industry survey, we spotted a trend worth noting. The number of contractors who own their own building either directly or through a related party has been steadily increasing over the last three years.

In fact, 69% of survey respondents said they own their building today, while only 55% reported owning their building. We believe this is a positive trend for the construction industry, as owning a building can have major benefits and it points to more business owners being confident about what the future holds.

As your business grows, you have two primary options when it comes to a workspace: you can purchase commercial property or lease a space. Working out of a virtual office is a potential third option, but that’s a conversation for another day, and sometimes doesn’t fit into a construction contractor’s business model.

Why Owning Makes Good Sense

When the owner of a construction business asks me if they should buy their own building, I almost always say “Yes, absolutely.”

The reason might be simpler than you think: contractors who own their building can enhance the value of that real estate at wholesale costs. With direct access to skilled construction employees, along with a contractor’s discount on materials, owners of construction employees can dramatically improve the value of their commercial property at a reasonable cost.

How It Worked for One Contractor

One of my construction clients purchased a building for their operations for $1.2 million in 1999. Over the years, during down periods, he put his employees to work and made significant renovations to his building. This was a smart move because otherwise, those employees would have been sitting around or getting laid off due to a slowdown in business.

Now, some 20 years later, the building has doubled in value and is substantially paid off. The owner’s retirement is about a year away, and as part of the transition he plans to sell the building, which will result in a net cash flow of $2 million. The contractor’s ownership of the building, and his smart decision to improve it, turned out to be an excellent retirement planning vehicle.

Tax Benefits of Owning Your Own Building

There are also some nice tax benefits to owning your own building. If you’ve built a new facility or purchased or renovated an existing building, you might have the opportunity, through a cost segregation study, to lower your tax burden by accelerating tax deductions. This can result in increased cash flow, a lower tax burden, and a deferral of taxes. Almost always, the tax benefits derived from a cost segregation study more than pay for the study itself.

I’ve been asked how commercial real estate is impacted by the Tax Cuts and Jobs Act, passed in 2017. Commercial real estate owners will still be able to deduct mortgage interest on their commercial property as they were allowed to do before. However, the building owner’s net income will, with the 20% business deduction, now be taxed closer to a federal 21% rate, down substantially from a possible high of 39.6%, putting real estate ownership on a level playing field. This lower tax rate is excellent news for business owners.

If you’ve renovated an old building, you’re in luck. The Historic Preservation and Rehabilitation Tax Credit is still in place under the new law. You’ll get a 20% credit for certified historic structures (although it must be claimed over a five-year period). The 10% credit for non-certified structures, however, has been eliminated.

Pro tip: your CPA should be helping you take advantage of every possible tax savings opportunity, including tax credits and incentives for construction contractors and tax credits for real estate investors.

When Leasing Might Be Better

As is the case with any big decision, there are always pros and cons to consider. There are times when it might make sense to lease instead of owning your own building. Leasing might be better than owning if:

-

Your business is new and you are still getting established

-

You don’t want the long term responsibility of building ownership

-

You simply don’t have the cash flow to buy

Need Help?

Contact us online or call 800.899.4623.