Dividing assets in a divorce is rarely a simple matter. It gets even more complicated when there is a transfer of property between spouses after a divorce.

When transferring assets as part of a negotiated settlement or divorce proceeding, it might not be possible to complete the transfer immediately due to financial or logistical reasons.

Timing is everything, as the saying goes.

It’s important to understand the rules regarding the transfer of property between spouses after a divorce, and how the timing impacts how — and whether — transactions are taxed.

Does the Transaction Qualify As a Section 1041 Transfer?

A good starting point is to determine whether the transaction qualifies as an IRC Section 1041 transfer.

Internal Revenue Code Section 1041 lays out the rules for property that is transferred between spouses who are divorcing or are divorced. It provides that a property transfer is incident to the divorce if it occurs within one year of the divorce, or if it is related to the cessation of the marriage.

If the transaction qualifies as a Section 1041 transfer, it is not subject to taxation and the basis of the asset carries over to the receiving spouse.

Special Rules Relating to Timing of Transfer

There are special rules relating to the timing of the transfer. To achieve the most advantageous financial outcome for a divorcing client, family law attorneys should consider how these special rules apply to their clients.

The One-Year and Six-Year Tests

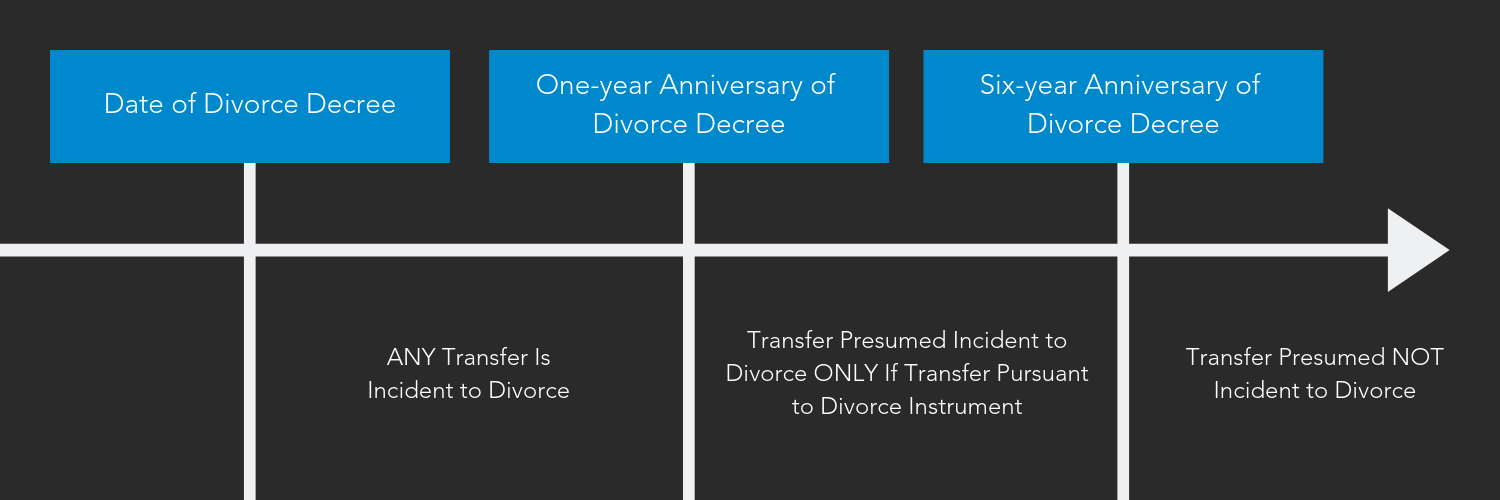

Let’s look at some key property transfer benchmarks on the divorce timeline:

Source: Thomson Reuters Checkpoint, 601 Applicability of IRC Sec. 1041

Transfers Taking Place Within One Year of the Divorce

No support or evidence is required when a transaction takes place within one year of the divorce. The presumption is that property transferred between former spouses is merely a shifting around of jointly owned assets and therefore, is not subject to taxation. This rule applies even if the transferred property was acquired after the divorce was final.

Consider this example:

John and Beth were divorced in July 2017. In January 2018, John purchased stock for $50,000. John then transferred the stock to Beth in June 2018, which increased in value to $60,000, to satisfy an obligation to her as part of the divorce settlement. No gain or loss would be recognized by John or Beth for this transaction.

Transfers Taking Place Between the One-Year and Six-Year Anniversary of the Divorce

A transfer of property that occurs between the one-year and six-year anniversary must be made pursuant to a divorce or separation instrument to be presumed related to the cessation of the marriage and qualify for Section 1041 treatment. A divorce or separation instrument includes a decree of divorce or separate maintenance, a written separation agreement, or other court decree.

It is also worth noting that a divorce instrument includes amendments or modifications to the instrument. A divorce instrument that does not provide for a transfer of property can be later modified to include one and will therefore ensure that no gain or loss will be recognized.

Private Letter Ruling 9306015 provides an example of a transfer of property found to be related to the cessation of the marriage:

Mr. and Ms. Young divorced in 1988. In 1989, they entered into a settlement agreement, which provided that Mr. Young deliver to Ms. Young a promissory note for $1.5 million, which was secured by 71 acres of land. In 1990, Mr. Young defaulted on this obligation and entered into a later settlement agreement to transfer 59 acres of land (42.3 acres of the original 71 acres and 16.7 acres of land adjoining that tract). In accordance with the later settlement agreement, Mr. Young retained an option to repurchase the land for $2.2 million on or before December 1992. Mr. Young assigned the option to a third party, who exercised the option and bought the land from Ms. Young for $2.2 million. No gain or loss was recognized on the transfer of the property from Mr. Young to his former spouse. Ms. Young took the marital basis of the land and recognized a gain on the subsequent sale to a third party.

Transfers Taking Place After the Six-Year Anniversary of the Divorce

In general, property transferred more than six years after the divorce is final does not qualify for Section 1041 treatment.

Any transfer that is not pursuant to a divorce or separation instrument and occurs more than six years after the divorce becomes final is presumed to be unrelated to the cessation of the marriage. While the IRS guidance is unclear, there are special circumstances in which property transfers after the six-year mark would qualify as a tax-free transfer.

The presumption that a transfer was not related to the cessation of the marriage “may be rebutted only by showing that the transfer was made to effect the division of property owned by the former spouses at the time of the cessation of the marriage. For example, the presumption may be rebutted by showing that (a) the transfer was not made within the one- and six-year periods described above because of factors which hampered an earlier transfer of the property, such as legal or business impediments to transfer or disputes concerning the value of the property owned at the time of the cessation of the marriage, and (b) the transfer is effected promptly after the impediment to transfer is removed.” (Source: Section 1.1041-1T(b), Q&A-7 of the Temporary Income Tax Regulations)

There is a documented case where the presumption that the transfer was not related to the cessation of the marriage was clearly rebutted.

In Private Letter Ruling 9235026 (May 29, 1992), the IRS ruled that the transfer of the wife’s interest in business property to her ex-husband was incident to the divorce even though the transfer occurred more than six years after the divorce. It was determined that the transfer was delayed because of a dispute over the purchase price and payments terms. After the disputed factors were resolved, the transfer was promptly completed. Temp. Treas. Reg. §1.1041-1T, A-7 specifically provides that the presumption may be rebutted only by showing that the transfer was made to effect the division of property owned by the former spouses at the time of the cessation of the marriage, and there were factors that hampered an earlier transfer of property.

To qualify for Section 1041 treatment, a transfer of property should take place before the six-year anniversary of a divorce and be supported by a divorce or separation agreement after the one-year anniversary of the divorce. In circumstances where the property transfer cannot be completed within a six-year time frame, the best support is a written divorce or separation agreement documenting the contemplated transfer, and support for why the transfer could not be completed during the six-year time frame. There are documented exceptions to the six-year rule, but the guidance is not clear and would surely be evaluated by the IRS based on the specific facts and circumstances surrounding the property transfer.

Need Help?

Our litigation support professionals help family law attorneys form solid financial strategies for their divorcing clients. Contact us online or call 800.899.4623 for help.