The Build Back Better Act (H.R. 5376) was introduced in the House of Representatives on September 27, 2021. If this bill is signed into law, it will have broad implications on estate planning, including changes to the unified credit, treatment of grantor trusts for tax purposes, and surcharges for high income estates and trusts.

Let’s take a close look at those major changes.

For business valuations, the largest change the bill proposes is the treatment of valuation discounts. The most common valuation discounts include discounts for lack of marketability (“DLOM”), discounts for lack of control (“DLOC”), and discounts for lack of voting rights. The application of these discounts will not be totally disallowed, but they will be limited regarding the type of business, or the assets held by a business.

The Build Back Better Act (“BBBA”) states that:

-

The value of any nonbusiness assets held by the entity with respect to such interest shall be determined as if the transferor had transferred such assets directly to the transferee (and no valuation discount shall be allowed with respect to such nonbusiness assets), and

-

Such nonbusiness assets shall not be taken into account in determining the value of the interest in the entity.

To unwrap this, we need to first define what constitutes a nonbusiness asset.

The BBBA defines a nonbusiness asset as any passive asset that is held for the production or collection of income and is not used in the active conduct of business. Some common examples of passive assets include cash, fixed income, ownership interests in another entity, annuities and real property (such as real estate). There is a working capital exemption for operating companies such that any passive asset held for reasonably required working capital shall be treated as used in the active conduct of a trade or business. Therefore, cash, a passive asset as defined by the BBBA, would be subject to valuation discounts if it is concluded to be part of reasonable working capital requirements.

Determining Whether an Entity Will be Affected by Proposed Changes

The first step to determine whether the transfer of a business interest is subject to valuation discounts — if the BBBA passes — would be to determine if the business is an operating or holding entity. An operating entity conducts business while a holding entity just holds passive assets like those mentioned above.

If the business entity is a holding entity, valuation discounts will not be applicable as the assets will be treated as if they were transferred directly to the transferee. If the business interest to be transferred is an operating entity, valuation discounts would be applicable, but could still be limited regarding the assets owned by the operating entity.

For example, if an operating entity owns a condominium that’s not used for business purposes, that asset’s value would not be subject to valuation discounts and would be treated as if the transferee received the pro-rata value of the condominium. If it’s determined that the operating entity has working capital above a reasonable level of working capital necessary for operations, that excess working capital would not be subject to valuation discounts and would be treated as if the transferee received the pro-rata value of the excess working capital.

Examples of Effect of BBBA’s Disallowance of Valuation Discounts for Nonbusiness Assets

To better demonstrate the impact of the disallowance of valuation discounts for nonbusiness assets, let’s examine two examples of how the bill would change how a gift is valued. For the examples, we will use a combined 20% DLOM and DLOC for demonstration purposes.

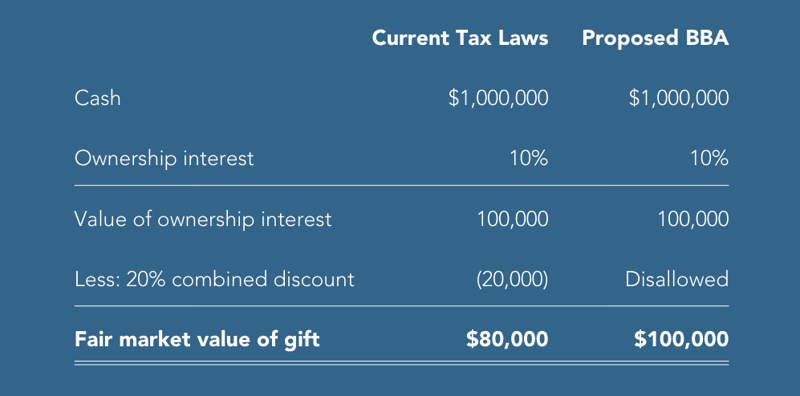

Example #1: Gifting of 10% interest In a Family Limited Partnership (“FLP”)

This FLP’s only asset is cash in the amount of $1 million, has no liabilities and has no business operations. Under current tax laws, discounts for lack of marketability and control can be considered. Under the proposed BBBA, they would be disallowed as the cash is not utilized in the conduct of business.

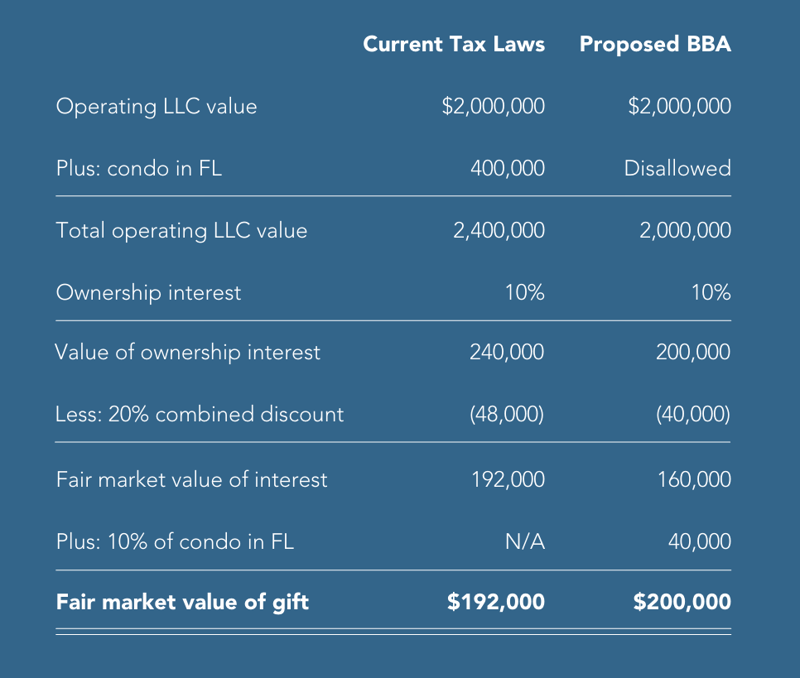

Example #2: Gifting of 10% Interest In an Operating LLC

This operating LLC’s value was determined to be $2 million. In addition to the operating value, the LLC owns a condo in Florida with a fair market value of $400,000. The condo in Florida is not used in the conduct in the business. Under current tax laws, discounts for lack of marketability and control can be considered. Under the proposed BBBA, they would be disallowed as the condo is not utilized in the conduct of business.

What’s Next?

If the BBBA passes, it would cause major changes in regards to estate planning. Typical estate planning strategies such as transferring interests in entities that hold nonbusiness assets to family members and utilizing discounts to reduce the value of the gift will no longer be available if the BBBA passes in its current form. The proposed change to disallowance of valuation discounts for nonbusiness assets would only apply to transfers after the date of enactment.

Need Help?

Contact us here or call 800.899.4623 for help.