If you have children or grandchildren, you’re likely concerned about the cost of their college education. For Marylanders, there is a little bit of relief in sight, thanks to the state teaming up with the Maryland College Investment Plan.

You might be eligible to receive matching funds from the state of Maryland if you meet certain criteria, but you must submit an application by May 31.

With the May 31 application deadline looming, let’s review the details to help you determine whether you qualify for the match.

Do You Qualify for the State of Maryland’s Match?

You (the account holder) may apply for matching funds if you meet the following requirements:

-

Maryland taxable income on your 2018 tax return does not exceed $175,000 (married filing jointly) or $112,500 (filing individually) — see table below

-

The beneficiary of the 529 plan is a Maryland resident

-

You open a new Maryland College Investment Plan account (current account holders may apply if the MCIP account was opened after December 31, 2016)

-

You submit your Save4College State Application program by May 31 (it must be postmarked by May 31)

-

You make at least the minimum contribution (see below) between January 1 and November 1 of the calendar year for which you apply

Income Thresholds for Applying

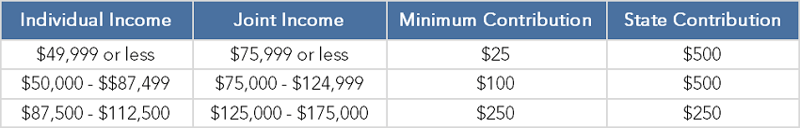

The chart below shows the taxable income thresholds, minimum contribution amounts (which must be contributed by November 1 of the calendar year for which you’re applying), and the state of Maryland’s match for qualified account holders.

The following example illustrates one possible scenario.

John and Kathy are married and file a joint tax return. In 2018, their Maryland taxable income was $72,357. They have two children, Scott and Lisa. They have never opened a college savings plan for their children. If they choose to take advantage of the 529 match program, they would be eligible to receive up to $2,000 by opening four new accounts (each spouse opens an account for each of their children separately). Their application is due by May 31 and the minimum contribution of $25 per account based on their income eligibility will need to be deposited by November 1.

How to Apply for the State Match

Log into your Maryland College Investment Plan account here and select “Ready, Set, Match.” If you don’t already have a 529 plan account, you can open one here.

You can read step-by-step instructions for applying for the match here (click “How do I apply?”).

What Is the Deadline for Applying?

Your application must be sent and postmarked no later than May 31.

Helpful Links

-

Save4College State Contribution Program FAQs

-

Log into your existing Maryland College Investment Plan account here

-

Open a Maryland College Investment Plan account here

Need Help?

Contact us online or call 800.899.4623 for help.

.png?width=338&height=400&name=Estate%20Planning%20Checklist%20mockup%20image%20(500px).png)