In dissolution of marriage cases, the valuation of marital property is necessary to ensure fair equitable distribution. But before values can be placed on marital property, the property first needs to be identified. As family law attorneys know, that process is more complicated than ever due to the rise of a new asset class: digital assets.

If you’re unfamiliar with digital assets, you’re not alone. Digital assets are electronic files of data that can be owned and transferred by individuals. It can be used as currency to make transactions or as a way of storing intangible content, such as computerized artworks, videos or contracts. Examples of digital assets include cryptocurrencies (crypto), asset-backed stablecoins (stablecoin) and non-fungible tokens (NFTs). You can learn more in our FAQs about cryptocurrency.

How Are Digital Assets Acquired?

To acquire digital assets, cash must be converted into crypto. This is done through a coin exchange platform. You deposit cash (via linking a bank account, debit card or credit card), which can either be used to purchase crypto directly or by purchasing stablecoins, such as U.S. Dollar Coin (USDC). The stablecoins can then can be exchanged for other cryptos.

Here are the top ten coin exchange platforms, measured by exchange score:

- Binance

- CoinbaseExchange

- FTX

- Kraken

- KuCoin

- Huobi Global

- Bitfinex

- Gate.io

- Binance.US

- Bybit

Like acquiring crypto, NFTs are acquired on NFT marketplaces, which are comparable to coin exchange platforms. To purchase NFTs on these marketplaces, you need to own crypto to facilitate the transaction. Most NFT marketplaces require a specific type of crypto, Ethereum, to perform transactions since the Ethereum network powers their transactions. Lastly, many of the coin exchange platforms have added the ability to acquire NFTs directly through their platform instead of using NFT marketplaces.

A new development in the acquisition of digital assets is Bitcoin ATMs. If you were to purchase crypto at a Bitcoin ATM, you would need to have cash on hand, deposit it into the machine and then select which crypto you would like to buy. This eliminates the process of linking a banking account, debit card or credit card to an account.

Crypto may also be acquired on popular stock trading applications and financial applications, but the selection of digital assets that can be acquired on these applications is limited. These include Robinhood, Webull, PayPal and CashApp. However, the crypto you acquire on Robinhood, Webull and PayPal is not directly owned by you as an individual. Instead, you own an interest in the crypto that’s owned by these services, so you’re unable to use this crypto for purchases such as NFTs.

How Are Digital Assets Stored?

Digital assets must be stored electronically since they are not tangible. The easiest place to store digital assets is through an account on one of the coin exchanges or NFT marketplaces. However, many digital asset holders choose to move their digital assets to a digital wallet.

Digital wallets are created, maintained and accessed via a computer or cell phone application in most cases. What makes digital wallets unique is that they require three inputs to access them: (1) a username, (2) a password and (3) a seed phrase.

A seed phrase is a sequence of about 12-24 words that are needed to set up or recreate your digital wallet. It is recommended that you either memorize or physically write down the seed phrase as hackers could obtain the seed phrase if they gain access to your computer. If you forget your seed phrase, the digital wallet will be lost. One individual had $321 million worth of Bitcoin in their digital wallet but forgot his seed phrase and can’t access his vast Bitcoin fortune.

Physical digital wallets recently appeared on the digital asset scene. In most cases, these digital wallets are about the size of a USB flash drive that connects to either a computer or phone. Digital assets are transferred to these devices, which are kept securely on the device offline. In addition, there are now physical digital wallets that resemble debit cards and gold/silver bullions.

Why Do Digital Assets Complicate the Process of Equitable Distribution?

As stated at the beginning of the article, before values can be placed on marital property, the property must first be identified. But identifying the existence of digital assets can be difficult since they are intangible.

Let’s look at the example of Mary and John, a divorcing couple.

During the discovery process Mary requests details regarding John’s Coinbase account, which she knows exists. In turn, John produces a screenshot of his account balance and the digital assets held in the account. At this point, Mary is confident the information provided is accurate and complete and no further requests are made regarding the Coinbase account. However, further investigation would have proven otherwise. By reviewing the transaction detail of John’s account, we could have seen that he keeps a small percentage of his digital portfolio in his Coinbase account, but he transferred most of it to a digital wallet or physical digital wallet. Without knowledge of John’s other digital assets, Mary won’t receive her share of these assets through equitable distribution.

6 Ways to Identify the Existence of Digital Assets

There are a number of ways to find evidence of digital assets. Here are six methods for detecting the existence of digital assets.

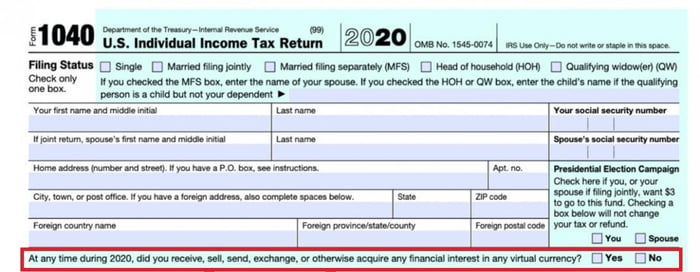

1. 2020 U.S. Federal Income Tax Return, Form 1040

This is the easiest, yet least reliable method. Beginning in tax year 2020, the IRS added a line on the first page of Form 1040 that asks if you received, sold or exchanged any cryptocurrency during 2020. This method of discovering the existence of digital assets, of course, is dependent on the person being honest.

If they marked this box “yes,” a spouse most likely owns crypto. However, the spouse could mark the box “no” while owning crypto if they acquired crypto prior to 2020.

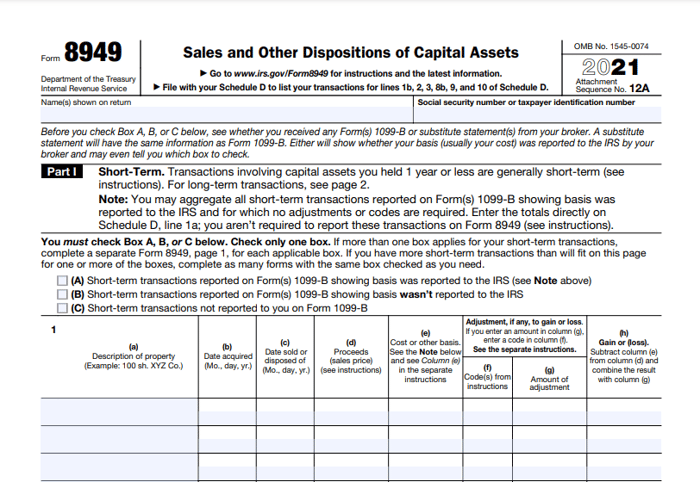

2. Historical U.S. Federal Income Tax Returns, Form 8949

The second easiest method to determine whether a person owns crypto is to review Form 8949 of their tax return in detail. This form captures sales and other dispositions of capital assets.

If you can identify any crypto reported, then it’s likely that the person owns crypto. However, this requires that the person was honest and reported their gains and losses. Nonetheless, reporting crypto gains and losses is rare because the exchanges have not and still do not issue Form 1099-Bs.

3. Form 1099-MISC for Rewards Beginning In 2021

Prior to tax year 2021, crypto exchanges did not issue any IRS tax forms to a customer who held an account through an exchange. While two of the largest exchanges used in the United States (Coinbase and Binance) have stated they will not issue 1099-B (gains and losses related to the selling of crypto), they have stated they will issue a 1099-MISC for rewards earned through their platform, interest on stablecoins or by staking their crypto (crypto’s quasi-stock dividend equivalent).

However, Coinbase and Binance have stated that the total of rewards, interest on USDC and staking rewards need to exceed $600 before they will issue a 1099-MISC. It is usually difficult to accumulate that much crytocurrency via rewards, interest and staking. If someone does receive one of these for the 2021 tax year, it most likely indicates they own quite a bit of crypto.

4. Bank and Credit Card Statements — Deposit and Withdrawal Setup for Coin Exchange

One of the first steps when creating an account for the various crypto exchanges is a test deposit and subsequent test withdrawal for the purpose of moving money from your bank account to your crypto account.

Generally, the crypto exchange will do two test deposits in very small amounts (generally $0.01 - $0.02). After the account holder confirms these amounts online, they will then be withdrawn in the same amounts. If you review bank and credit card statements and see deposits in extremely small amounts and subsequent withdrawals in the same amount, it is likely that person has a crypto exchange account.

5. Bank and Credit Card Statements — Transfers to Coin Exchanges

When reviewing bank statements, it is important to identify any vendors for popular crypto exchanges as this will indicate they are investing in crypto. The most commonly used coin exchanges are listed above.

6. Strange Devices — Physical Crypto Wallet

If someone owns a physical crypto wallet, it most likely indicates they own crypto. These devices generally resemble USB flash drives but can also look similar to debit cards or gold/silver bullion as shown below.

Image source: www.cada.news

Need Help?

Contact us here or call 800.899.4623 for help.