If you own real estate, tax planning is crucial because it can help you reduce your tax liability, increase profitability and avoid unexpected tax bills. By understanding and applying tax strategies, real estate owners can make the most of deductions, credits and incentives specifically designed for property owners, such as depreciation, capital gains and cost segregation.

Let’s look closely at cost segregation, an often-overlooked tax strategy for owners of real estate.

What Is Cost Segregation?

A cost segregation study is a tax strategy — available to real estate owners — that uses accelerated depreciation deductions to decrease income taxes and increase cash flow.

For real estate owners, depreciation is typically broken out into two categories: building and land. Buildings are depreciated over 27.5 years if residential, and 39 years if commercial. Land, on the other hand, is not depreciated.

Depreciation allows for buildings to be written off over time, but due to the long duration at which they are depreciated, it does not amount to significant tax deductions year to year. A cost segregation study can be beneficial to advance deductions forward for the owner. This will allow the owner to utilize the time value of money by getting a large portion of the deduction up front rather than over time.

How Does Cost Segregation Work?

A cost segregation study is performed by qualified engineers and/or CPAs, who apply the Internal Revenue Code and the Unit of Property rules to segment a building into additional categories beyond just building and land. The additional categories, personal property and land improvements, come with a much shorter time frame over which the assets can be depreciated.

This more detailed segmentation of real estate allows for some components to be deducted over five, seven and 15 years instead of depreciating the entire building over 27.5 (residential) or 39 (commercial) years.

An added benefit of using a cost segregation study to segment components into five, seven and 15-year life property is that this property falls under the bonus depreciation rules and can have an even larger amount deducted in their first year. As of this article’s publishing, the bonus depreciation rate will be 60% in 2024, 40% in 2025, 20% in 2026, and 0% in 2027 and thereafter. This would allow for 60% of an asset to be deducted in the first year if purchased in 2024.

Real-Life Example of a Cost Segregation Study and Its Benefits

Let’s say you purchased a commercial building on January 1, 2024 for $2,500,000. Without a cost segregation study, the building is $2,000,000 and the land is $500,000. The building is depreciated over the next 39 years and will result in a deduction in 2024 of $51,282. Remember, the land is not depreciated.

Without a Cost Segregation Study

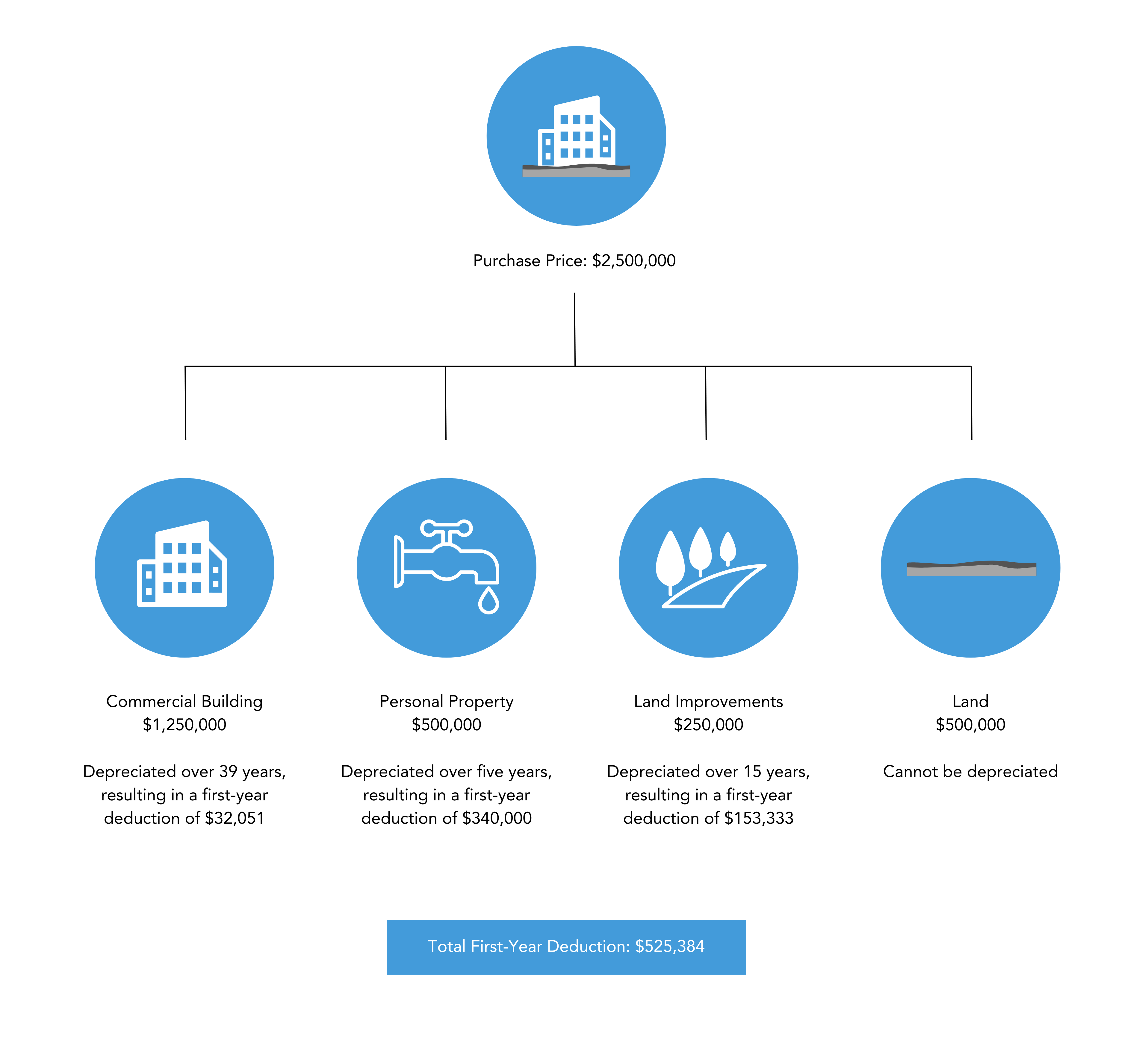

Let’s look at the same scenario but with a cost segregation study performed. The study shows land valued at $500,000, a building value of $1,250,000, personal property valued at $500,000 and land improvements of $250,000.

The total purchase is still the original $2,500,000. However, with bonus depreciation and a shorter useful life on which depreciation is calculated, the first-year deduction is significantly higher. The building would still be depreciated over 39 years, resulting in a deduction of $32,051. The personal property, including the bonus depreciation of 60%, would have a first-year deduction totaling $340,000. The land improvements, including the bonus depreciation of 60%, would have a first-year deduction totaling $153,333.

The total first-year deduction with a cost segregation study would be $525,384 versus a $51,282 deduction without a cost segregation study.

With a Cost Segregation Study

Need Help?

As you can see, there are significant benefits to doing a cost segregation study. In addition to yielding an immediate tax benefit, cost segregation can significantly reduce your tax liability while improving cash flow.

Contact us here or call 800.899.4623 to learn whether a cost segregation study is the right tax strategy for you and your real estate.