As one of the most frequently committed white-collar crimes in the United States, check tampering is one of the most common fraud schemes in nonprofit organizations. Often committed by a fraudster who is involved in reconciling the organization’s bank statements, check tampering typically involves a fraudster who uses their authority to hide the existence of the fraud by altering accounting systems or bank statements.

Unfortunately, the majority of check tampering schemes do not consist of a single occurrence, but instead continue over an extended period of time, making prevention all the more important.

In my webinar, Fraud Prevention for Nonprofits: Avoiding Fraud Schemes and Fraudsters, I discussed some common fraud schemes nonprofits face and ways to prevent them. We’ve already talked about billing schemes on our blog. This article focuses on check tampering — what it is, how to identify the red flags and how to detect and prevent it.

What Are the Types of Check Tampering?

Check tampering allows fraudsters to steal organization funds by forging or otherwise alerting an organizational check. There are four principle types of check tampering:

1. Forged Maker

This type of check tampering involves forging the signature of an authorized signatory.

2. Forged Endorsement

Forging the signature endorsement of an intended recipient of a company check is another kind of check tampering.

3. Altered Payee

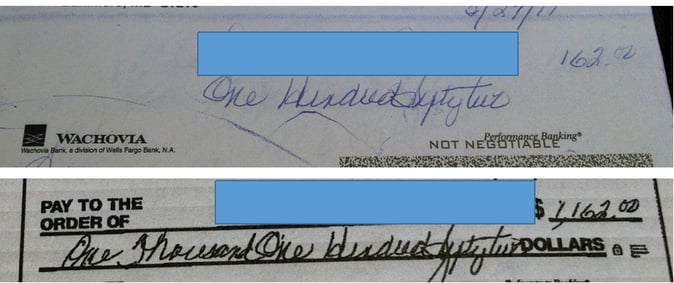

This kind of fraud involves purposely miswriting a check either by changing the company name (e.g., ABC changed to A.B. Company) or the amount on the check. For example, in the images below the fraudster purposely left room on the amount line in order to fraudulently add the extra $1,000.

4. Authorized Maker

In this scheme, the fraudster is the person authorized to prepare and sign the checks.

What Are the Red Flags?

First and foremost, be aware of customer and vendor complaints about missing payments. More often than not, the companies and clients that you do business with can serve as excellent sources when it comes raising red flags about diverted checks and missing money.

Some other common red flags when it comes to check tampering include:

-

Voided or missing checks

-

Altered endorsements or dual endorsements of returned checks

-

Returned checks with obviously forged or questionable signatures

-

Altered payees on returned checks

-

Customer complaints regarding payments not being applied to their accounts

-

Checks payable to employees, with the exception of regular payroll checks

How Do I Catch the Fraudster?

The ability to perform account analysis through bank cut-off statements or online access is especially important when it comes to detecting check tampering.

Your organization should have immediate access to your financial records so that if a problem does arise, you are able to investigate the issue as quickly as possible. Most banks keep a scanned record of each check cashed, and it is important to review these records throughout the year in order to catch any fraud in its infancy.

In addition, bank reconciliations are extremely important in detecting check tampering. Organizations should examine bank statements for possible alterations and cancelled checks, and review endorsements on a regular basis.

How Can I Prevent Check Tampering In My Organization?

1. Checks Should Never Be Pre-signed

Ever. When it comes to check tampering prevention, this tip is your golden goose. Remember, while we’d like to put our utmost trust in our co-workers, fraudsters come in all shapes and sizes, and often hold a degree of authority in an organization. Don’t put your nonprofit at risk by putting too much trust in the wrong person, and know the warning signs that an employee may be stealing from your organization.

2. Use Bank Assisted Controls

For example, almost all banks offer positive pay, a service that works to identify fraudulent checks by matching the account number, check number and dollar amount of a check against all checks previously cut by the organization.

3. Physical Tampering Prevention On Checks

Most modern checks disallow erasing and use heat sensitive ink to prevent any physical tampering.

4. Check Cutting Is Done By Someone Who Is Not a Signatory On the Account

This ensures another instance of control, which can help circumvent the idea of fraud well before it begins. Remember, internal controls serve as your main defense against fraudsters.

5. Mail Is Opened By Someone Other Than the Person Who Cuts the Checks

Having another person open mail helps ensure that vendor complaints or notifications of missing payments will be seen by someone other than the fraudster.

Need Help?

One great way to better understand fraud is by talking to experts who can answer your questions, give you some real-life fraud prevention tips and point out any red flags. One of our nonprofit fraud experts would love to talk with you about how you can better protect your organization from fraud and spot any warning signs that could suggest fraud is already underway.

Contact us online or call 800.899.4623.