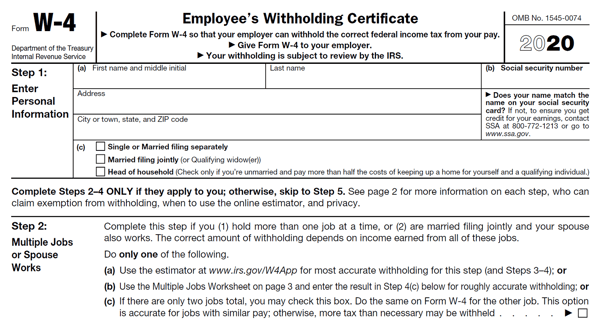

The long awaited new Form W-4 is finally here. Here’s the rundown on the new form, which businesses must start using for new employees hired on or after January 1, 2020.

Form W-4 is a payroll form that employers must receive when a new employee is hired. The form can also be used by employees who wish to adjust their payroll withholding. More than 80% of tax payments into the system come from the taxpayer’s withholding.

The new Form W-4 eliminates any reference to “allowances,” which were tied to personal exemptions claimed on the taxpayer’s Form 1040. These were removed due to tax law changes.

In revising the form, the IRS aimed to reduce the form’s complexity and improve the accuracy of the withholding system. Let’s take a look at the key changes you should be aware of.

W-4 Changes for 2020

In essence, the new Form W-4 revises the calculation of federal withholding for employees and can include multiple jobs, claiming dependents and optional lines to include non-wage income and deductions.

Following are the key changes to the form:

- In Step 2 of the form, families with two or more jobs can choose one of three options, which involve tradeoffs between accuracy, privacy and ease of use.

- The new form, in Step 3, has additional steps for claiming dependent credits and for deductions above the standard deduction.

- In Step 4 of the form, employees with non-job income (e.g., investment income) can indicate extra withholding to be taken for each pay period.

The IRS’s tax withholding estimator can help taxpayers determine a more accurate calculation for Steps 2 or 4 on the form.

You can download the 2020 Employee’s Withholding Certificate, AKA Form W-4, here. As a reminder, you must start using it in 2020.

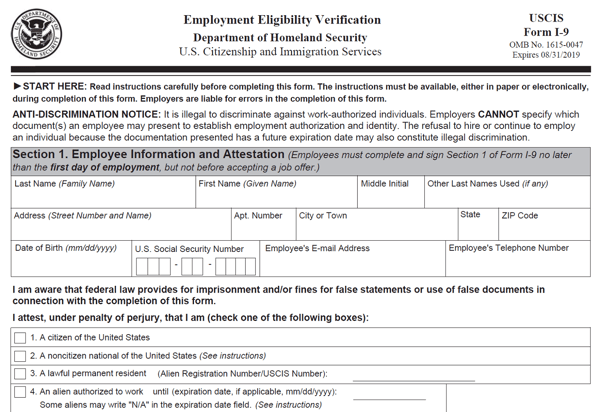

Don’t Forget the USCIS Form I-9

In related news, employers must also receive USCIS Form I-9, AKA Employment Eligibility Verification, from all employees.

The Form I-9 process, managed by the U.S. Citizenship and Immigration Services, is designed to help employers verify the employee’s identity and employment authorization. It is a good practice to store these forms separately from employees’ personnel records.

The Form I-9 process, managed by the U.S. Citizenship and Immigration Services, is designed to help employers verify the employee’s identity and employment authorization. It is a good practice to store these forms separately from employees’ personnel records.

You can download a fillable and paper version of Form I-9 here.

Need Help?

Contact us online or call 800.899.4623.