Maybe you have a new contract that requires an audit or maybe your bank requested audited financial statements. If you’re a construction contractor, a first-time audit can seem overwhelming and daunting.

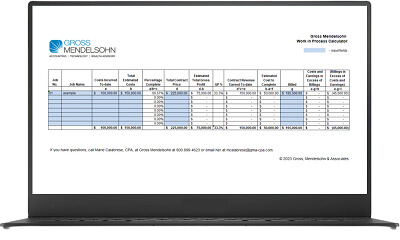

Because your work in process schedule is crucial to your company’s revenue recognition, we’ve identified the top three things contractors can do when preparing their WIP schedule as part of the financial statement audit.

Have no fear. Here's how to make the audit of your WIP schedule go as smoothly as possible.

1. Make sure all contracts, including change orders, are included on the WIP schedule

It’s important to make sure your WIP schedule is up to date and includes all signed contracts. You also want to make sure you’ve adjusted the WIP schedule to reflect any approved change orders. It’s helpful to have all contracts and change orders in one central location.

Many contractors create a log of contracts and change orders that reconcile to the WIP schedule to help with the audit. Not only will this limit the number of questions your auditors might have, it will also keep you and your team organized and ensure you are properly recognizing revenue throughout the year.

2. Reconcile the contract revenue and contract costs to the general ledger

All transactions are posted and recorded to the general ledger. The general ledger and ultimately the trial balance will form the basis of the financial statements that your auditor will provide an audit opinion on. It’s important to reconcile the contract revenue and contract cost accounts in the trial balance to the WIP schedule. This will allow your auditor to ensure the WIP schedule and general ledger are complete and accurate. It can also allow your auditor to select job costs and other samples directly from the general ledger.

3. Review the WIP schedule with your project managers

Your project managers are in the field regularly and communicating with the owner of the job frequently. You want to make sure your project manager has closely reviewed the WIP schedule to ensure accuracy. No matter how hard the strongest CFOs and controllers try, they usually don’t have enough project-specific knowledge of each job. Project managers should pay close attention to the percent completion on the job. If there have been significant changes in estimated costs (whether favorable or unfavorable), these will need to be revised to ensure proper revenue recognition.

Need Help?

Contact us here or call 800.899.4623.